- Home

Probate Attorney

We’ll help you plan your estate to protect your interest

Call: 203-586-1930 Or Request an Appointment

Professional Estate Planning and Probate Legal Services in Connecticut

Losing a loved one is one of the most stressful times in our lives. When faced with wrapping up the affairs of a loved one who has died, it is normal to feel overwhelmed by the complexity by the amount of documents that the court will require. Attorney William K. Gernert will help you every step of the way to make the probate process more manageable.

A skilled Connecticut probate attorney, William K. Gernert is experienced and efficient in all probate and estate matters. He’ll help to make your burden a little lighter. Although most of Attorney Gernert’s estate and probate work is in New Haven county, we do serve all areas of Connecticut.

Call: 203-586-1930

Or Request an Appointment

Why Choose Us As Your Probate Attorney?

Experience you can rely on, expertise you can trust.

The Law Office of William K. Gernert has more than two decades of experience providing legal guidance to clients in and around Connecticut.

We have a deep understanding of legal matters about estate planning and probate. Our team works cooperatively with you to ensure that you make intelligent and informed decisions at every step of the process.

Our legal team has extensive experience in creating and modifying comprehensive estate plans for our clients. We utilize strategies including the creation of trusts, the re-titling of assets and other legal mechanisms to safely transfer your business assets.

We have the knowledge and experience to assist you in minimizing estate taxes and safeguarding your selected beneficiaries. Our documents are written in straightforward language and include specific details of our plans. After the documents are signed, we work with you to implement and update the plan, as well as to verify that it continues to fulfill your needs.

The Law Office of William K. Gernert has helped hundreds of our clients in planning, transferring, and protecting their assets. Their glowing reviews prove our commitment to high standards of service and excellence.

Each client and estate plan is different. Our team will take the time to understand your specific personal situation and advise you to build a plan that is suited to your requirements and goals.

EXPERIENCE

The Law Office of William K. Gernert has more than two decades of experience providing legal guidance to clients in and around Connecticut.

IN-DEPTH LEGAL KNOWLEDGE

Attorney Gernert has a deep understanding of legal matters about estate planning and probate. He works with you to help make intelligent and informed decisions at every step of the process.

SPECIALIZED EXPERIENCE

Attorney Gernert has extensive experience in creating and modifying comprehensive estate plans for his clients. He utilizes strategies including the creation of trusts, the re-titling of assets and other legal mechanisms to safely transfer your assets.

CUSTOMIZED SOLUTIONS

Each client and estate plan is different. Attorney Gernert will take the time to understand your specific personal situation and advise you to build a plan that is suited to your requirements and goals.

WE WORK WITH CLIENTS AT ALL STAGES OF LIFE

Our customers vary from young persons creating their first estate plans to senior adults seeking assistance in caring for an aging spouse or themselves.

Probate and Estate Planning Services

Expert and in-depth legal counsel to expedite the probate

We perform the following services in estate planning and probate administration:

POWERS OF ATTORNEY

The Law Office of William K. Gernert can help our clients to create Power of Attorney (POA) or Durable Power of Attorney (DOA) to communicate clients’ wishes if they are unable to do so in the future.

PROBATE

We help clients with estate and trust administration, whether the assets are in probate or not, and whether the client is an executor, administrator, trustee, or beneficiary.

CHARITABLE DONATIONS

William K. Gernert helps clients reach their charitable giving goals by structuring contributions, establishing charitable trusts, collaborating with nonprofits, or establishing a foundation of their design.

WILLS AND TRUSTS

Attorney Gernert assists clients in the creation of their wills and trust, which allows them to appoint guardians for their minor children and distribute their assets as you see fit, and appoint an individual or entity to administer your estate.

PROTECTION OF ASSETS THROUGH HEALTHCARE DIRECTIVES

If long-term care and nursing facility costs are a concern, we can devise a strategy that allows you to qualify for government assistance while conserving your assets to the maximum extent permitted by law. We can also protect assets for those who are entitled to disability compensation.

FIXING ESTATE PLANNING ISSUES FOR BENEFITING THE HEIR(S)

Even major estate planning issues are frequently correctable after death. Over the years, we have helped clients reduce or eliminate inheritance taxes, remedy flaws in estate plans, and put otherwise invalid estate planning contracts into effect—even after death.

Probate and Estate Planning Services

Expert and in-depth legal counsel to expedite the probate process.

We perform the following services in estate planning and probate administration:

WILLS AND TRUSTS

Attorney Gernert assists clients in the creation of their wills and trust, which allows them to appoint guardians for their minor children and distribute their assets as you see fit, and appoint an individual or entity to administer your estate.

PROBATE

We help clients with estate and trust administration, whether the assets are in probate or not, and whether the client is an executor, administrator, trustee, or beneficiary.

CHARITABLE DONATIONS

William K. Gernert helps clients reach their charitable giving goals by structuring contributions, establishing charitable trusts, collaborating with nonprofits, or establishing a foundation of their design.

POWERS OF ATTORNEY

A Power of Attorney is a legal document that allows someone to act on your behalf. They are commonly used to permit a trusted family member or friend to act when you are unable to.

TITLE 19 APPLICATIONS

Attorney William K. Gernert can help individuals file for Medicaid Medicaid (aka Title 19) which is a set of jointly funded federal and state programs that provide health coverage to individuals who qualify.

The Law Office of William K. Gernert also perform the following tasks:

- Locating and protecting estate assets

- Obtaining evaluations for the deceased’s real estate

- Assisting with bill and debt payment of the deceased

- Preparing and submitting all paperwork necessary by a probate court

- Determining the tax implications of an estate.

- Setting up trusts to avoid probate and ensure a seamless transfer of assets to your loved ones.

- Transferring assets in the name of the decedent to the beneficiaries

- Assisting administrator/beneficiary in obtaining funds quickly to pay estate bills

I knew that the probate process was very difficult and time consuming since my neighbor had just gone through this when his mother died. I knew that I need a probate attorney to help me. A friend told me about Atty Gernert and she was right. He took care of all of the paperwork and attended the hearings with me.

A.V.

What are the Benefits of Estate Planning?

Plan your estate before you pass

Estate planning is important because of the following reasons:

- Protect Your Assets: An estate plan ensures that your assets remain available to you and your loved ones. It’s no surprise that one of the main reasons people decide to prepare an estate plan is to avoid probate. A lawsuit or divorce may wreak havoc, and if you don’t have a plan in place, everything you’ve worked so hard to establish can disintegrate before your very eyes.

- Benefit the People You Love: Estate planning allows you to take care of your children or spouse even after your death. If you have special needs children or children who are very young, estate planning can ensure that they are taken care of the way you intended.

- Avoid Probate: Probate is expensive and time-consuming. Estate planning allows you to avoid probate and complete the transfer of estate as soon as possible.

- Minimize Taxes: Depending on how your estate is structured, you may be able to significantly decrease or even eliminate any estate taxes that would otherwise apply to a spouse’s inheritance. There are various methods for reducing the cost of inheritance taxes on other heirs.

An Overview of the Probate Process in Connecticut

1: Application for Administration or Probate of Will

An application, along with the original Will and death certificate is submitted to the probate court. From this point, the court will appoint an executor. If there is no Will, the court will appoint an Administrator.

2: Inventory of Assets

The executor or administrator is required to marshal the deceased’s assets. The value is derived from the date of the deceased’s death. All of the assets that the deceased owned on the day of their death is reported to the probate court. This must be completed within two months from the date that the executor or administrator is appointed.

3: Expenses are Paid

Before the contents of a will may be carried out, the will must be “probated” or “proven” in the probate court in a proceeding to determine the will’s legality. As part of this process, the court approves the appointment of the executor indicated in the will.

4: File Estate Tax Returns

Within 6 months after the deceased’s date of death, a Connecticut estate tax return must be filed. The return must be filed regardless of the value of the estate.

5: Federal Estate Tax Return

Federal Estate Tax Returns must also be filed if the value of the estate is over $2,000,000.

6: Final Accounting and Proposed Distribution

This form reflects all of the financial activity of the estate. It begins with the initial inventory that was filed and includes all of the expenses that were paid and income received during the probate process. It also includes the proposed list of distributions to the beneficiaries of the estate assets.

This above is meant to be a brief overview of the steps involved in probating an estate in Connecticut. Attorney Gernert can help you with this difficult process.

Having a lawyer on your side who can assist you in dealing with these claims in a timely manner can help

to accelerate the process for everyone concerned. Schedule an appointment today.

How can a probate attorney help?

A probate attorney can make the law work for you.

A Southbury probate attorney can assist you in the following ways.

- Legal Documentation: A probate attorney assists in the estate planning process by writing down your desires for incapacity and death. The attorney will know which documents to employ and will present solutions to ensure that your objectives are met.

- Educate you about Law and its Implications: An estate law attorney will be familiar with state and federal rules that may affect how your estate is inventoried, valued, distributed, and taxed following your death, and will appropriately educate you about the probate procedure if it becomes necessary.

- Designating Beneficiaries: Probate attorneys can help to allocate assets to beneficiaries. They are neutral third-party and will listen to your needs and offer advice when needed.

- Avoid the Long Probate Process: Going through probate is quite expensive, lengthy, and extremely public. It can be avoided if you hire an attorney who ensures that all your assets are properly designated.

- Lower Taxes: An attorney can minimize taxes on your estate by creating strategies involving tax knowledge.

- Advice on Healthcare Directives: An estate planning attorney can help you choose the best person to carry out your health wishes. Being a third party, we can guide you on who might be the best person to serve in this role.

- Charitable Contributions: An attorney can help in the administration of retirement plans, life insurance policies, and charitable contributions.

Having a lawyer on your side can assist you in dealing with these claims promptly. It can help to accelerate the process for everyone concerned.

faq

Estate planning is a way of distributing one’s assets after death. There are various legal routes for protecting one’s estate, most of which involve a will.

A Power of Attorney is a legal document you use to allow another person to act for you. You create a legal relationship in which you are the principal and the person you appoint is the agent. A Power of Attorney specifies the powers you give to your agent. The powers can be limited or broad. For example, if you are selling your house, but unable to attend the closing, you can give someone the power just to sign the deed in your absence.

An estate includes all of one’s property and assets. It encompasses both real property (such as a house) and personal property (bank accounts, investment, etc).

You can use estate planning to make the transfer of ownership to your loved ones as simple and inexpensive as feasible. Estate taxes, court fees, and legal fees can all be avoided with good planning.

While the law does not require a will. There is no reason why you should not have one. A will permits you to plan ahead of time your wishes and desires for asset distribution.

In general, hiring an estate planning lawyer to assist with the creation of a will is a good idea. To create a legally binding will, several legal prerequisites must be met. The larger your estate, the more vital it is to plan ahead of time and spend time thinking about how to organize your will.

In Connecticut, there are two types of taxes that are passed onto the heirs. The estate tax is a tax levied on a person’s estate after he or she dies but before the money is distributed to heirs. It is also known as the “death tax.” Only estates exceeding a particular value are liable to the estate tax.

The inheritance tax is charged after a person’s estate has been distributed to his or her dependents. While the estate tax is deducted from the estate, the recipients must pay the inheritance tax.

In Connecticut, even a reasonably easy estate should anticipate taking at least six months to probate if formal probate is required. Creditors have three months from the date notice was provided within which to file claims against the estate.

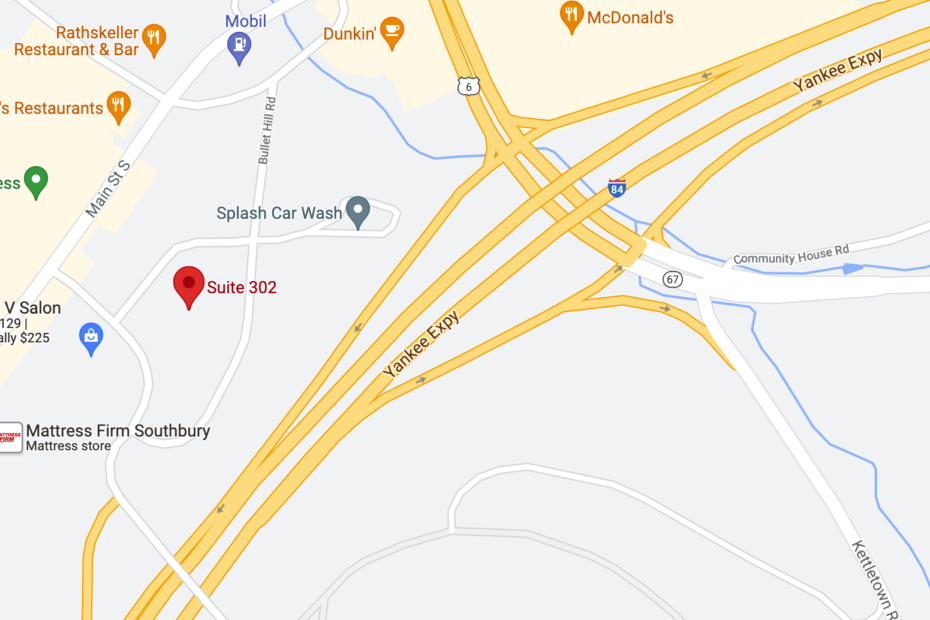

SOUTHBURY BASED PROBATE ATTORNEY SERVING THE GREATER CONNECTICUT AREA FOR OVER 20 YEARS

The Law Office of William K. Gernert provides Legal Services specific to probate law, bankruptcy law and real estate law. Located in Southbury, CT, we have been providing legal services in CT for over 20 years.

or call: 203-586-1930

The information on this website is for general information purposes only. Nothing on this site should be taken as legal advice for any individual case or situation. This information is not intended to create, and receipt or viewing does not constitute, an attorney-client relationship.

© 2020 All Rights Reserved | Design by Magnetic WP